Costly spreadsheet mistakes are far more common than one would expect. A simple miscalculation cost JPMorgan Chase $6.2 million in 2012 after a trader added cells instead of averaged. A copy/paste error cost the Canadian-based electric power generator company, TransAlta, $24 million in a contract purchase after the mistake increased purchase prices. These mishaps provide an interesting headline and expose the great risk of relying on error-prone spreadsheets.

Spreadsheets have been a pivotal tool dating back to 1985 and should be part of the business system, but not the business system itself. Managing risks pertaining to portfolios, projects, cyber programs, assets, and other business operations requires a more sophisticated system than a spreadsheet. Research shows spreadsheets, such as Microsoft Excel are outdated, ineffective tools because they are slow, error-prone, lacks transparency, and offers little capability for predictive analysis. Your organization could be at a disadvantage using spreadsheets and falling behind the competition.

Does it feel like you’re constantly swimming in numerous spreadsheets? You’re not alone!

Public utilities are required to submit risk assessment mitigation plans to State agencies and typically they will use spreadsheets to develop the work papers. In this scenario, over 30 excel files are created with each having multiple tabs. This often results in hundreds of individual spreadsheets for one annual submittal. Fast forward a few years and that propagates to thousands of spreadsheets and hundreds of data files. Should the organization want to see the variances for the past five years, it would be a daunting task to navigate the excessive amounts of spreadsheets to review and compile a report.

Disadvantages of using spreadsheets

It’s never too late to move away from manual activities and makeshift risk management spreadsheets that pigeonhole the business. There are many reasons to bring innovative solutions to business processes and adopt technology in lieu of spreadsheets. Some key disadvantages of using a spreadsheet include:

- In a fast-evolving industry, spreadsheets lack innovation and are not forward thinking.

- Spreadsheets are a single-user, static tool. They can be a valuable tool but on an individual level.

- Requires manual effort to collect data leading to a high probability of human error when compiling data and sharing reports.

- Difficult to collaborate and share updates, patterns, and trends on dashboards across an organization.

- Requires advanced excel knowledge to create complex formulas for better analytical insight.

- Lack of security regarding access control and file corruption.

- Not compatible with real-time data, insights, planning, forecasting, and reporting.

- Limited accessibility on mobile or other devices.

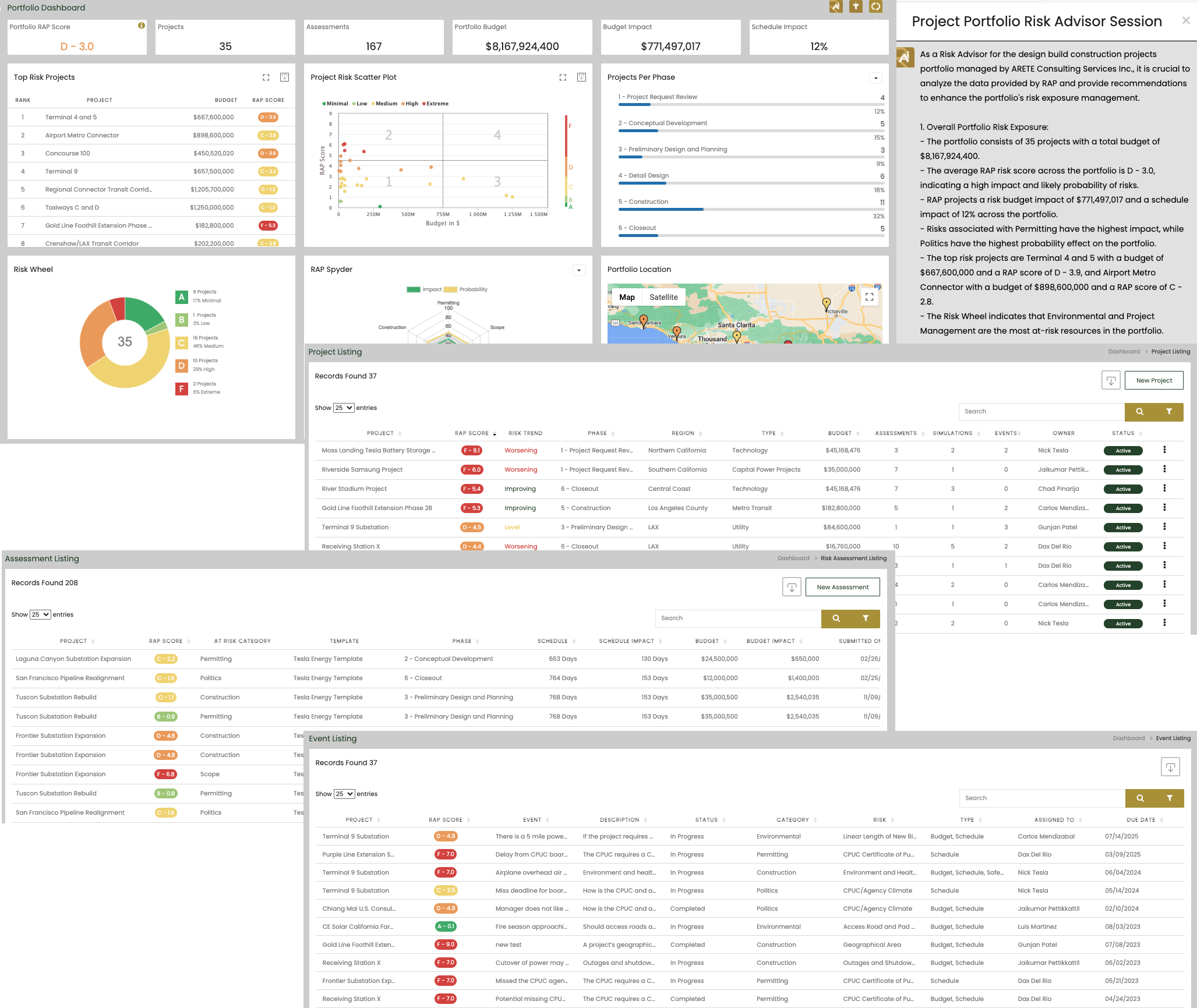

These are among the many reasons that companies are moving away from spreadsheets to cloud-based applications such as ARETE’s Risk Assessment Profiler (RAP). In fact, RAP’s original concept was created using Excel while working with a major utility but then the inventors of RAP ran into the limitations of using spreadsheets when managing risks in a portfolio of projects. Ultimately, this led the ARETE team to design and build the RAP platform as a software solution to better manage and perform risk management.

Advantages of using RAP

The Risk Assessment Profiler (RAP) is a cloud-based risk management platform that empowers managers to identify, understand, manage, and mitigate risk factors for a portfolio of projects, assets, and critical operational functions. The following are a few of the many reason’s organizations are switching from spreadsheets to RAP:

- A holistic and systematic approach to building an effective standard risk management program to meet your specific business requirements.

- Automated risk management workflow – increasing productivity and eliminating manual work and human errors.

- Standardized risk management processes with clear enterprise visibility via advanced risk qualitative, simulation and quantitative analysis.

- Efficient data management – of all risk aspects and its consolidation and maintenance of information in one place.

- Integration possibilities with Primavera P6, MS Project, SAP and other data management systems – breaking down the silos, providing users with a unified system for managing risk data.

- Collaboration platform for all parties involved in the risk management processes, including managers, executives, and admins.

- Task management – planning, execution, tracking, and reporting with the possibility to assign responsible people, track risk activities, and set mitigation deadlines.

- Comprehensive monitoring and reporting – real-time dashboards, and a set of pre-defined reports, providing excellent support for users during the risk management processes.

- Simplification of risk management routine – streamlining risk management activities by utilizing the user-friendly risk platform that includes modules to perform risk assessments, Monte Carlo simulations, and manage risk registers.

- Regular updates and enhancements to the software solution with every new release.

- AI Risk Advisor with the integration of Artifical Intelligence RAP provides an online Risk Advisor providing an analysis on the risk data and mitigating recommendations.

Conclusion

With the increasing changes in the rapid global trend for innovation, many companies have concluded that spreadsheets are more likely to pose problems than being an efficient solution for handling risk management processes. To keep up with the trends, more and more organizations are switching to dedicated risk management solutions like ARETE’s Risk Assessment Profiler (RAP). Contact us at info@arete-inc.com to schedule a free demonstration of the RAP tool!